2021 Watchlist 1st Quarter Review

- Leo Q

- Apr 26, 2021

- 2 min read

Here is a follow-up first quarter review of my 2021 recommendations post published Jan 9th 2021.

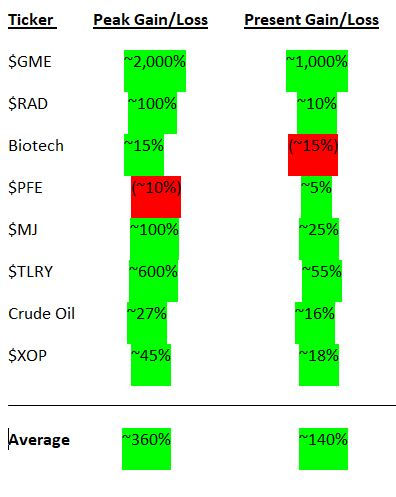

GME:

Gamestop has gained more than 20x from January to its peak. It's currently sitting ~$150 which is still 10x from the time of recommendation.

RAD:

Rite Aid has climbed up to a peak of $32, which is ~100% gain from the time of recommendation. It is currently sitting at $18.37 which is ~10% gain.

Biotech:

The biotech sector has slightly climbed ~15% in February. However it is has declined significantly since then and is now ~15% below the January price.

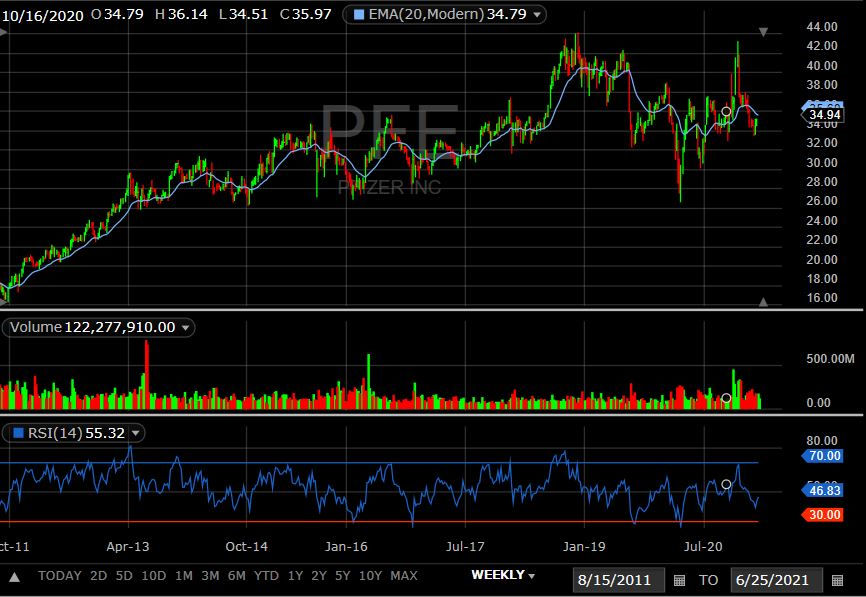

PFE:

Pfizer has dipped a lot lower than expected. It dropped as low as ~10% in March below the January price. It recently rebound and is now ~5% above the time of recommendation. This one has been moving sideways and a break out might come later than expected.

Cannabis Sector:

The cannabis sector has gone a massive run up since January. MJ peaked at $34 for ~100% gain since the last post. It is now consolidating around $21, which is still ~25% above January price.

Meanwhile, my personal choice of cannabis stock ($TLRY) has risen 600% from January to its February peak. It experience a massive short squeeze similar to $GME for major gains.

Crude Oil:

Crude oil has also ran up significantly (~27%) since January to its peak around $67.

It is currently sitting at $62 which is around ~16% gain from January.

XOP (S&P Oil and Gas Exploration and Production) has gained ~45% from January up to its peak of ~$92. It currently is slowly declining back down to ~$75, which is still around 18% above the January price.

Performance:

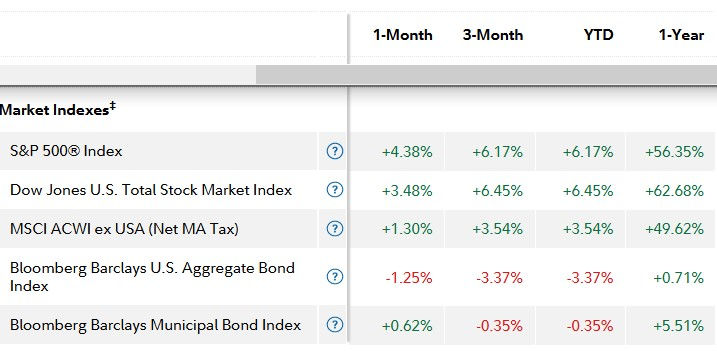

My 2021 stock picks are definitely outperforming the major market indexes.

Almost all of the individual picks have significantly increased in price as expected, with the exception of biotech sector and $PFE. The $GME short-squeeze event, being an outlier of the group, gave the watchlist a huge boost.

If $GME gains were taken out of the calculation, the watchlist still outperforms the indices by more than 100%! (~16% YTD)

My near-term predictions are crude oil will have a huge move to the upside for the coming months, while biotech and cannabis could consolidate for a while before continuation of the uptrend.

Good luck traders!

Comments